1 2 sol 1969 Federal Reserve Bank Peru: A Detailed Overview

The Federal Reserve Bank of Peru, established in 1969, plays a pivotal role in the country’s financial system. This article delves into the history, functions, and significance of the bank, providing a comprehensive understanding of its operations and impact on the Peruvian economy.

History and Establishment

The Federal Reserve Bank of Peru was founded on December 2, 1969, following the enactment of Law No. 1969. The bank was established to promote monetary stability, regulate financial institutions, and foster economic growth in Peru.

Functions and Responsibilities

The Federal Reserve Bank of Peru holds several key functions and responsibilities within the Peruvian financial system:

| Function | Description |

|---|---|

| Monetary Policy | Formulates and implements monetary policy to maintain price stability and promote economic growth. |

| Bank Supervision | Oversees and regulates financial institutions to ensure their stability and compliance with regulations. |

| Currency Issuance | Issues and manages the circulation of the Peruvian sol, the country’s official currency. |

| Payment Systems | Operates and maintains payment systems to facilitate the smooth functioning of the financial sector. |

| International Relations | Engages in international cooperation and exchange of information with other central banks and financial institutions. |

Monetary Policy and Price Stability

The Federal Reserve Bank of Peru is responsible for formulating and implementing monetary policy to maintain price stability. The bank achieves this by adjusting interest rates, controlling the money supply, and managing inflationary pressures. By keeping inflation in check, the bank contributes to a stable economic environment, which is crucial for sustainable growth.

Bank Supervision and Financial Stability

Bank supervision is another critical function of the Federal Reserve Bank of Peru. The bank oversees financial institutions, including commercial banks, to ensure their stability and compliance with regulations. This supervision helps prevent financial crises, protect depositors’ interests, and maintain the overall stability of the financial system.

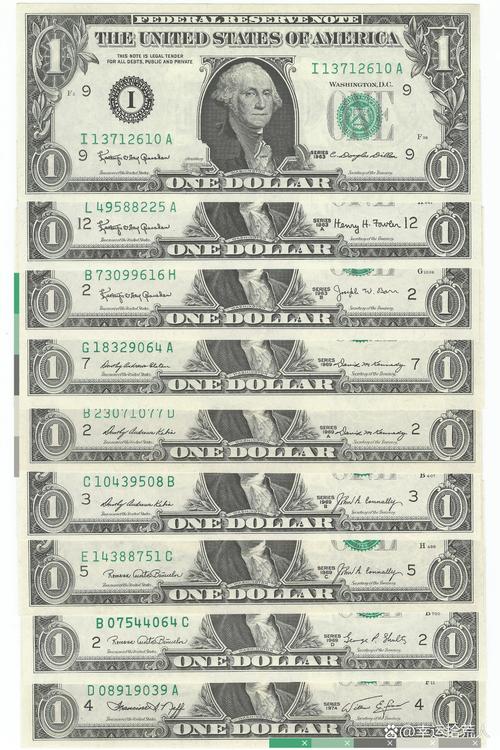

Currency Issuance and Management

The Federal Reserve Bank of Peru is responsible for issuing and managing the circulation of the Peruvian sol. The bank ensures the availability of currency to meet the country’s needs, while also maintaining the integrity and security of the currency. By managing the currency supply, the bank contributes to the stability of the financial system and the overall economy.

Payment Systems and Financial Infrastructure

The Federal Reserve Bank of Peru operates and maintains payment systems that facilitate the smooth functioning of the financial sector. These systems include the national payment system, which enables the transfer of funds between banks and financial institutions, and the interbank clearing system, which ensures the timely settlement of transactions.

International Cooperation and Exchange of Information

The Federal Reserve Bank of Peru actively engages in international cooperation and exchange of information with other central banks and financial institutions. This collaboration helps the bank stay updated on global financial trends and best practices, enabling it to make informed decisions and contribute to the stability of the global financial system.

Impact on the Peruvian Economy

The Federal Reserve Bank of Peru has had a significant impact on the Peruvian economy since its establishment. By maintaining price stability, fostering financial stability, and promoting economic growth, the bank has contributed to the country’s development. The bank’s efforts have helped create a conducive environment for investment, job creation, and overall prosperity.

Conclusion

The Federal Reserve Bank of Peru, established in 1969, plays a crucial role in the Peruvian financial system. By formulating and implementing monetary policy, overseeing financial institutions, managing the currency, operating payment systems, and engaging in international cooperation, the bank contributes to the stability and growth of the Peruvian economy. Its efforts have helped shape the country’s financial landscape and fostered economic development over the years.