10 Advantages of Being a Sole Trader

Embarking on the journey of entrepreneurship can be an exhilarating experience, and one of the most straightforward paths to get started is by becoming a sole trader. As a sole trader, you are the sole owner and operator of your business, which means you have the autonomy to make decisions and shape the direction of your venture. Here are ten advantages of being a sole trader that you might find appealing:

1. Complete Control and Autonomy

As a sole trader, you have the ultimate authority over all aspects of your business. This includes making decisions about the business strategy, operations, and even the hiring of staff. This level of control allows you to tailor your business to your vision and preferences.

2. Simplicity in Setup and Management

Compared to other business structures, setting up as a sole trader is relatively straightforward. You typically need to register your business with the appropriate government authorities, obtain any necessary licenses, and open a business bank account. The management of a sole trader business is also simpler, as you don’t have to deal with the complexities of partnerships or corporate governance.

3. Lower Costs

Operating as a sole trader can be more cost-effective than other business structures. There are fewer legal and administrative requirements, which can reduce the costs associated with setting up and maintaining a business. Additionally, you won’t need to pay dividends to shareholders or distribute profits to partners.

4. Tax Efficiency

As a sole trader, you are taxed on your personal income, which can be more tax-efficient than corporate tax. You can also claim a range of business expenses on your tax return, which can help to reduce your taxable income.

5. Quick Decision-Making

Without the need for multiple stakeholders to agree on decisions, you can make decisions quickly and efficiently. This agility can be crucial in a fast-paced business environment, allowing you to respond swiftly to market changes and opportunities.

6. Personal Branding

As the face of your business, you have the opportunity to build a strong personal brand. This can be beneficial for attracting customers and clients, as well as for networking and business development.

7. Flexibility

Being a sole trader offers you the flexibility to work from anywhere, set your own hours, and take time off when you need it. This can lead to a better work-life balance and a more productive work environment.

8. Direct Profit Sharing

As the sole owner of your business, you get to keep all the profits. This can be a significant advantage, as you don’t have to share your earnings with partners or shareholders.

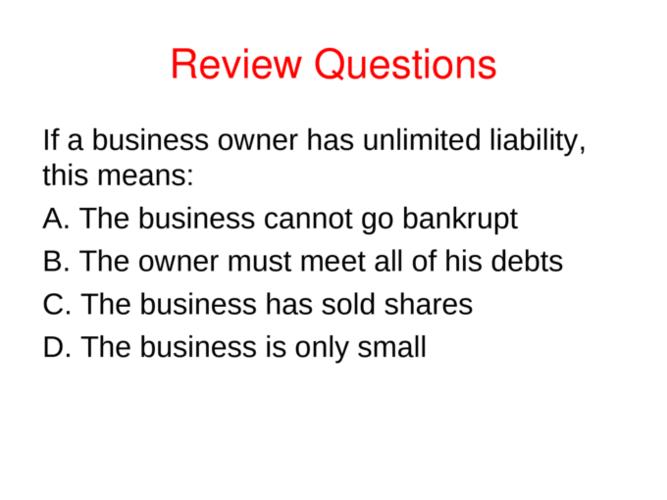

9. Personal Liability

While personal liability can be a concern for sole traders, it also means that you have the opportunity to build your business with your own resources. This can be a powerful motivator and can lead to a stronger sense of ownership and commitment to your business’s success.

10. Access to Government Support

Sole traders often have access to various government grants, subsidies, and support programs designed to help small businesses grow and thrive. This can provide valuable financial assistance and resources to help you get started or expand your business.

While being a sole trader offers numerous advantages, it’s important to weigh these against the potential challenges. As a sole trader, you are responsible for all aspects of the business, including its financial success or failure. It’s also important to consider the risks of personal liability and the need for effective time management and financial planning.

Here’s a table summarizing the key advantages of being a sole trader: