Solid US Gold American Eagle Coins: A Comprehensive Guide

When it comes to investing in precious metals, the American Gold Eagle coin stands out as a symbol of wealth and stability. Crafted from 22-karat gold, these coins are not only a store of value but also a piece of American history. In this detailed guide, we will explore the various aspects of solid US Gold American Eagle coins, including their design, value, and investment potential.

Design and Aesthetics

The American Gold Eagle coin is renowned for its exquisite design, which features a blend of American history and artistic excellence. The obverse side of the coin showcases Lady Liberty, designed by Augustus Saint-Gaudens, who is also responsible for the iconic $20 Gold Double Eagle. Lady Liberty is depicted walking towards the sun, symbolizing freedom and prosperity. The reverse side of the coin features a majestic bald eagle, perched on a rock, with an olive branch in its talons, representing peace, and arrows in the other, symbolizing strength.

The coin’s design has undergone a few changes over the years. The original design, which was minted from 1986 to 1991, featured a more traditional depiction of Lady Liberty. However, in 1992, the United States Mint introduced a new design, which has been used ever since. This new design, created by Adolph A. Weinman, features a more modern and dynamic Lady Liberty.

Composition and Purity

Solid US Gold American Eagle coins are composed of 22-karat gold, which is 91.67% pure gold. The remaining 8.33% is made up of alloys, primarily copper and silver, which are added to enhance the coin’s durability and resistance to tarnishing. The high purity of the gold ensures that the coin retains its value over time.

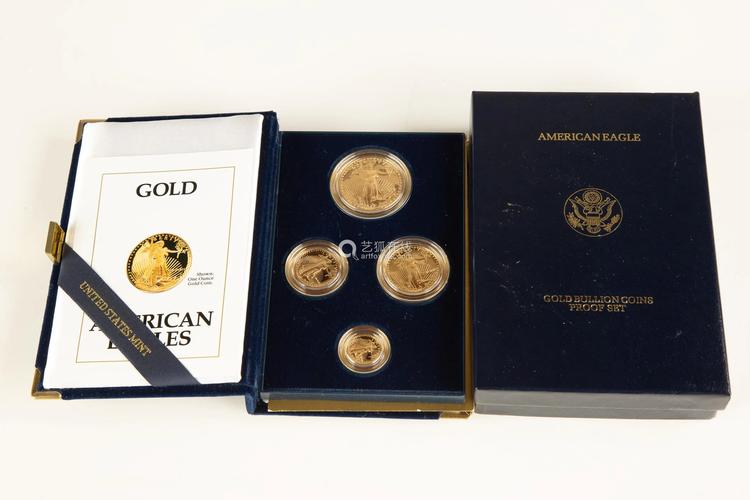

The United States Mint guarantees the weight and purity of each coin. The coins are minted in three denominations: $10, $25, and $50. The $10 coin contains one-tenth of an ounce of gold, the $25 coin contains one-quarter of an ounce, and the $50 coin contains one-half of an ounce. The table below provides a summary of the composition and weight of each denomination:

| Denomination | Gold Content | Weight |

|---|---|---|

| $10 | 0.1 troy ounces | 1.0999 troy ounces |

| $25 | 0.25 troy ounces | 1.5981 troy ounces |

| $50 | 0.5 troy ounces | 3.2158 troy ounces |

Investment Potential

Investing in solid US Gold American Eagle coins can be a wise decision, especially during times of economic uncertainty. Gold is often considered a safe haven investment, as it tends to hold its value or increase in value during market downturns. Here are some reasons why these coins are a popular choice among investors:

-

Historical Performance: Gold has been a valuable asset for centuries, and its price has historically increased over time.

-

Market Stability: Gold is not directly tied to the stock market or other financial instruments, making it a stable investment during economic turmoil.

-

Physical Asset: Owning physical gold provides a tangible asset that can be stored and sold at any time.

-

Legal Tender: American Gold Eagle coins are recognized as legal tender in the United States, which adds to their value and liquidity.

Buying and Selling

When purchasing solid US Gold American Eagle coins, it is essential to buy from a reputable dealer or a government mint. The price of these coins is influenced by several factors, including the spot price of gold, minting fees, and dealer premiums. The spot price of gold is the current market price per ounce of gold, and it fluctuates daily.

When selling your coins, you can expect to receive a price that is slightly lower than the purchase price, due to dealer fees and other costs. It is advisable to compare prices from multiple dealers before selling your coins to ensure you get