Understanding the Price of Solo Crypto: A Comprehensive Guide

When it comes to the world of cryptocurrencies, the price of solo crypto can be a complex and ever-changing factor. Whether you’re a seasoned investor or just dipping your toes into the crypto pool, understanding the factors that influence the price of solo crypto is crucial. In this article, we’ll delve into the various dimensions that contribute to the price of solo crypto, providing you with a comprehensive guide to help you navigate this dynamic market.

Market Supply and Demand

The price of solo crypto is primarily driven by the forces of supply and demand. Just like any other commodity, the value of a cryptocurrency is determined by how much people are willing to pay for it and how much of it is available in the market. When demand for a particular cryptocurrency increases, its price tends to rise, and vice versa.

Let’s take a look at some key factors that influence supply and demand:

| Factor | Description |

|---|---|

| Market Sentiment | Investor confidence and sentiment can significantly impact the demand for a cryptocurrency. Positive news or developments can lead to increased demand and higher prices, while negative news can have the opposite effect. |

| Adoption Rate | The rate at which new users adopt a cryptocurrency can also influence its demand. A higher adoption rate often leads to increased demand and higher prices. |

| Market Competition | Competition from other cryptocurrencies can affect the demand for a particular crypto. If a new, more innovative cryptocurrency enters the market, it may attract some of the demand away from existing cryptocurrencies. |

| Supply Constraints | Some cryptocurrencies have a limited supply, which can make them more valuable. For example, Bitcoin has a maximum supply of 21 million coins, which can create scarcity and drive up prices. |

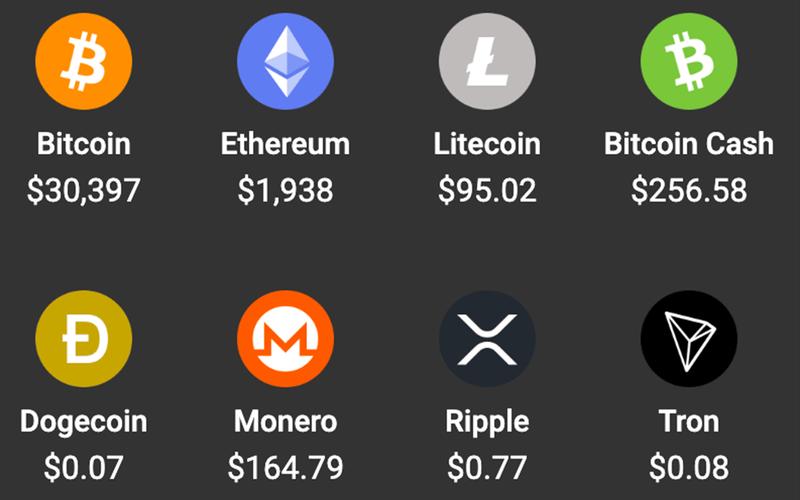

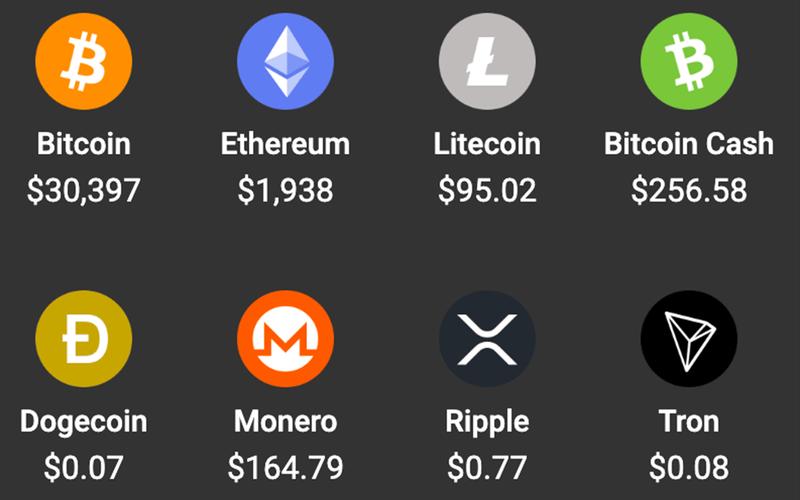

Market Capitalization

Market capitalization is another important factor that influences the price of solo crypto. It represents the total value of all the coins in circulation and is calculated by multiplying the current price of the cryptocurrency by the number of coins in circulation.

Market capitalization can be a good indicator of a cryptocurrency’s overall value and stability. Generally, cryptocurrencies with higher market capitalizations are considered more established and less volatile, while those with lower market capitalizations may be riskier but have the potential for higher returns.

Technological Advancements

Technological advancements play a crucial role in the price of solo crypto. Innovations in blockchain technology, security, and scalability can make a cryptocurrency more attractive to investors and users, leading to increased demand and higher prices.

Let’s explore some key technological factors that can impact the price of solo crypto:

| Factor | Description |

|---|---|

| Blockchain Technology | Advancements in blockchain technology, such as improved consensus algorithms or increased transaction speeds, can make a cryptocurrency more efficient and attractive to users. |

| Security | Enhanced security features, such as improved encryption or better resistance to hacking, can make a cryptocurrency more reliable and trustworthy. |

| Scalability | Improved scalability can allow a cryptocurrency to handle more transactions per second, making it more suitable for widespread adoption. |

Economic Factors

Economic factors, such as inflation, interest rates, and currency fluctuations, can also impact the price of solo crypto. In times of economic uncertainty, investors may turn to cryptocurrencies as a safe haven, driving up their prices. Conversely, during periods of economic stability, the demand for cryptocurrencies may decrease.

Let’s take a look at some key economic factors that can influence the price of solo crypto:

| Factor | Description |

|---|---|

| Inflation | Inflation can erode the purchasing power of fiat currencies,

相关文章LIKE |