Sol Crypto Analysis: A Comprehensive Guide

Understanding the world of cryptocurrencies can be daunting, especially when it comes to analyzing specific coins like Solana (SOL). In this detailed guide, we will delve into various aspects of Sol crypto analysis, providing you with a comprehensive understanding of this popular digital asset.

Market Overview

As of the latest data available, Solana has emerged as one of the leading cryptocurrencies in terms of market capitalization and transaction speed. With a market cap of over $50 billion, SOL has gained significant attention from both retail and institutional investors.

One of the key factors contributing to Solana’s popularity is its high-speed transaction capabilities. Unlike traditional blockchains like Bitcoin and Ethereum, Solana can process over 50,000 transactions per second, making it an ideal platform for decentralized applications (dApps) and smart contracts.

Technical Analysis

When analyzing Sol crypto, technical analysis plays a crucial role. This section will cover various technical indicators and chart patterns that can help you make informed decisions.

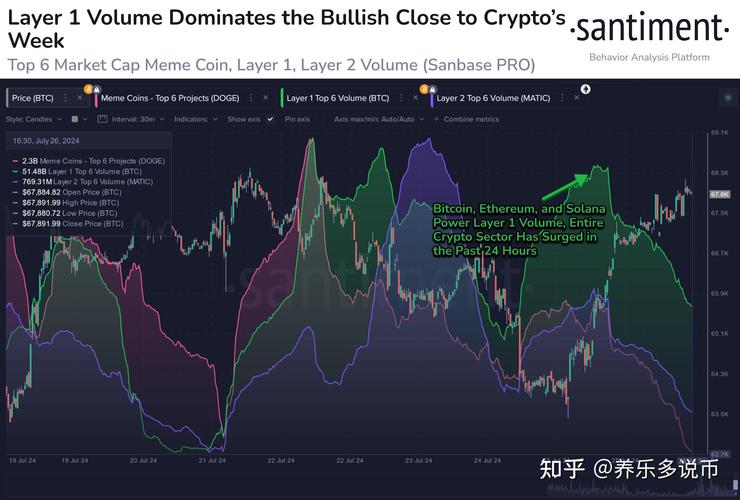

Volume: Tracking the trading volume of SOL is essential to understand market sentiment. A high trading volume indicates strong interest in the asset, while a low volume may suggest a lack of interest or potential manipulation.

Price Patterns: Identifying patterns like head and shoulders, triangles, and flags can provide insights into potential price movements. For instance, a head and shoulders pattern often indicates a reversal in trend, while a triangle pattern suggests consolidation before a significant move.

Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. A reading above 70 indicates an overbought condition, suggesting a potential pullback, while a reading below 30 indicates an oversold condition, indicating a potential rally.

On-Chain Analysis

On-chain analysis involves examining the underlying data of a blockchain to gain insights into network activity and user behavior. Here are some key metrics to consider when analyzing Sol crypto:

Transaction Fees: Tracking transaction fees can provide insights into network congestion and demand for the asset. Higher fees often indicate increased demand, while lower fees may suggest a decrease in interest.

Active Addresses: The number of active addresses on the Solana network can indicate the level of network activity and adoption. An increasing number of active addresses suggests growing interest in the platform.

Block Time: Solana’s ability to process over 50,000 transactions per second is a significant advantage. Monitoring the block time can help you understand the network’s efficiency and potential for scaling.

Market Sentiment

Market sentiment plays a crucial role in the price movements of cryptocurrencies. Here are some factors that can influence market sentiment for Solana:

News and Announcements: Keeping up with the latest news and announcements related to Solana can provide insights into potential price movements. For instance, partnerships with major companies or regulatory news can significantly impact market sentiment.

Community Engagement: The level of community engagement on social media platforms and forums can indicate the strength and support for Solana. A strong and active community can contribute to increased adoption and demand for the asset.

Conclusion

Understanding Sol crypto analysis requires a comprehensive approach, considering various factors such as market overview, technical analysis, on-chain analysis, and market sentiment. By staying informed and analyzing these aspects, you can make more informed decisions when investing in Solana or any other cryptocurrency.

| Technical Indicator | Description |

|---|---|

| Volume | Indicates the level of interest in the asset |

| Price Patterns | Identifies potential price movements and reversals |

| RSI | Measures the speed and change of price movements |