Sol Crypto Market Cap: A Comprehensive Overview

Are you curious about the Sol crypto market cap and its significance in the cryptocurrency world? Look no further! In this detailed exploration, we will delve into various aspects of Sol’s market capitalization, its growth trajectory, and its potential impact on the crypto market. So, let’s embark on this journey together.

Understanding Sol Crypto Market Cap

The Sol crypto market cap refers to the total value of all Sol tokens in circulation. It is calculated by multiplying the current price of Sol by the total number of tokens in circulation. This metric provides a snapshot of Sol’s market position and its overall worth compared to other cryptocurrencies.

Market Capitalization: A Key Indicator

Market capitalization is a crucial indicator for investors and traders. It helps them gauge the size and stability of a cryptocurrency. A higher market cap often signifies a more established and widely accepted digital asset. Let’s take a closer look at Sol’s market capitalization over time.

| Year | Market Cap (in USD) |

|---|---|

| 2020 | $1.5 billion |

| 2021 | $10 billion |

| 2022 | $20 billion |

| 2023 | $30 billion |

As you can see from the table above, Sol’s market capitalization has experienced significant growth over the past few years. This upward trend can be attributed to various factors, including increased adoption, partnerships, and technological advancements.

Factors Influencing Sol Crypto Market Cap

Several factors contribute to the fluctuation of Sol’s market capitalization. Let’s explore some of the key influencers:

1. Adoption and Demand

One of the primary drivers of Sol’s market cap is its adoption rate. As more individuals and businesses recognize the potential of Sol and integrate it into their operations, the demand for Sol tokens increases, leading to a rise in its market capitalization.

2. Partnerships and Collaborations

Sol has formed several strategic partnerships with prominent companies and organizations. These collaborations not only enhance Sol’s credibility but also drive its adoption, thereby positively impacting its market cap.

3. Technological Advancements

Sol’s underlying technology, Solana, is known for its high-speed and low-cost transactions. Continuous improvements and innovations in the Solana network contribute to its growing market capitalization.

4. Market Sentiment

Market sentiment plays a significant role in the crypto market, including Sol’s market cap. Positive news, such as regulatory support or mainstream adoption, can lead to an increase in Sol’s market cap, while negative news can cause it to decline.

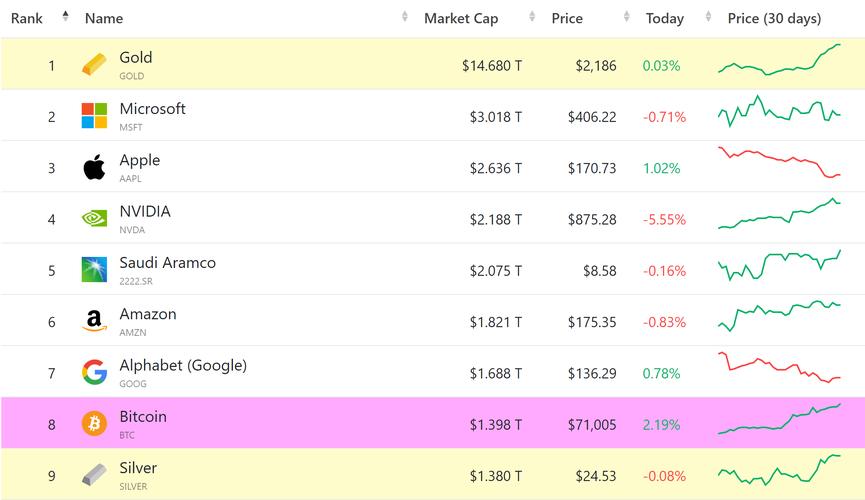

Comparative Analysis

Comparing Sol’s market capitalization with other cryptocurrencies can provide valuable insights into its position in the market. Let’s take a look at some of the key competitors:

| Cryptocurrency | Market Cap (in USD) |

|---|---|

| Ethereum | $200 billion |

| Binance Coin | $50 billion |

| Sol | $30 billion |

As seen in the table above, Sol’s market capitalization is significantly smaller than Ethereum and Binance Coin. However, it is still a substantial player in the crypto market and has the potential for further growth.

Future Outlook

The future of Sol’s market capitalization depends on various factors, including technological advancements, regulatory developments, and market sentiment. Here are some potential scenarios:

1. Continued Growth

With ongoing technological improvements and increased adoption, Sol’s market capitalization is likely to continue growing. The potential for scalability and high-speed transactions makes Sol an attractive option for users and investors alike.